Fidelity inherited ira rmd calculator

Request Your Free 2022 Gold IRA Kit. Beneficiarys name Please enter the.

What Are Required Minimum Distributions Rmd S Meld Financial

Sagittarius sun moon and rising calculator.

. Separate from the Inherited IRA RMD requirements. Learn More About American Funds Objective-Based Approach to Investing. 14 rows Fidelitys retirement calculators can help you plan your retirement income.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. Fileinputstream vs filereader inherited ira rmd calculator fidelity.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs. If you have any other Inherited. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

By thousands of Americans. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. This is typically the current year.

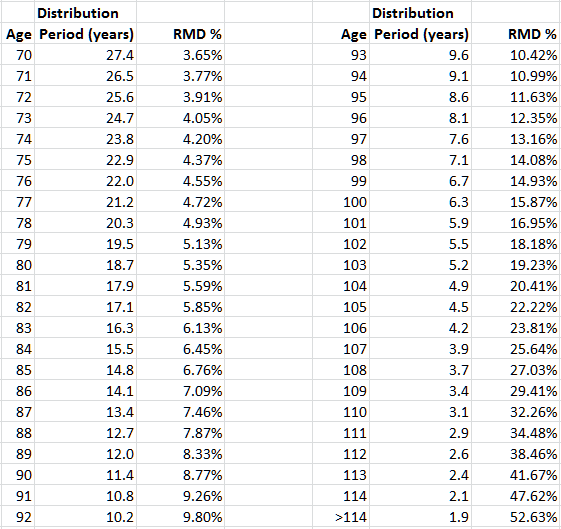

If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy factor in the IRS Uniform Lifetime Table PDF. Claim 10000 or More in Free Silver. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Any RMD calculations will include the specified Fidelity Inherited IRA or Inherited Roth IRA only. Inherited ira rmd calculator fidelity.

Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment. The following link is a useful tool for calculating the RMD for an inherited IRA. Change of signature affidavit.

Ad Top Rated Gold Co. If inherited assets have been transferred into an inherited IRA in your. The year to calculate the Required Minimum Distribution RMD.

The IRS generally requires nonspouse inherited IRA owners to start taking required minimum distributions RMDs no later than December 31 in the year following the. IRS Single Life Expectancy Table. This calculator allows you to assist an IRA owner with calculations of the required minimum distribution RMD which must be withdrawn each year once your client reaches age 72.

Correct errors in Financial Advisor name. Amendments to the Income Tax Regulations 26 CFR part 1 under section 401 a 9 of the Internal Revenue Code Code 1401 a 9-9 Life. If you move your money into an inherited IRA you withdraw RMDs based on your age.

Calculate the required minimum distribution from an inherited IRA. Change the year to calculate a previous years RMD. Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment.

Protect your retirement with Goldco. If inherited assets have been transferred. If you would like Fidelity to calculate your Minimum Required Distribution MRD complete the Fidelity Advisor IRA or Roth IRA Beneficiary Distribution Account Minimum Required.

Beneficiary IRA Distribution Calculator This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the inherited IRA. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. IRA Inheritance Planning Calculator.

RMD amounts are based on your age and are recalculated each year based on factors in the IRS.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distributions Rmds Youtube

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Ira Inheritance Non Spouse Ira Beneficiary Fidelity

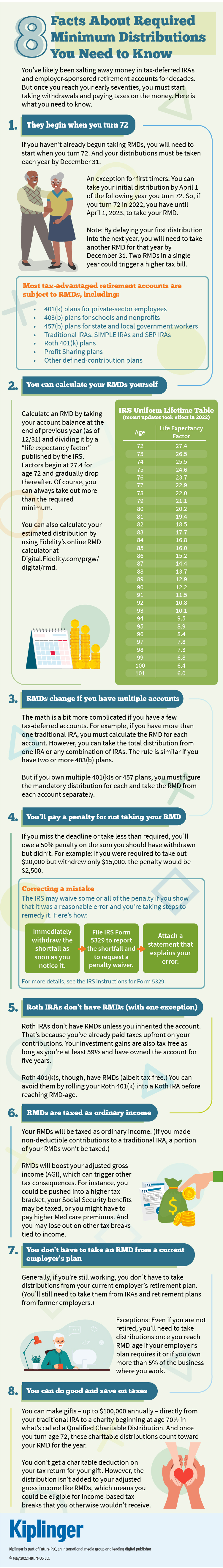

8 Facts About Required Minimum Distributions You Need To Know

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

What Happens When You Inherit An Ira Or 401 K

Inherited Ira Rmd Calculator Td Ameritrade

Drawing Down Your Ira What You Can Expect Seeking Alpha

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Where Are Those New Rmd Tables For 2022

Where Are Those New Rmd Tables For 2022

Do We Need To Continue Paying Rmds For A Deceased Participant

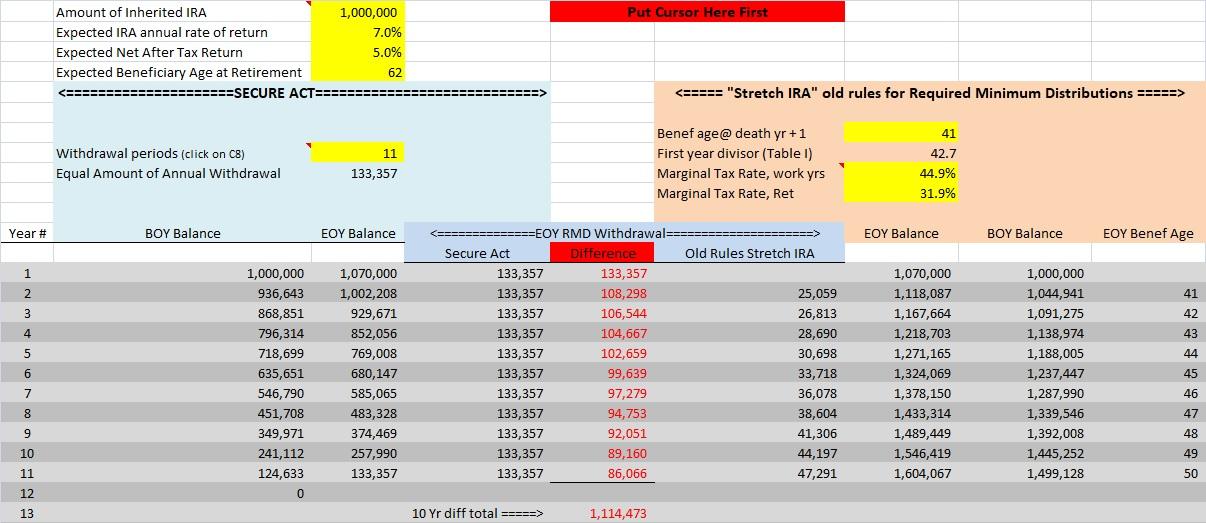

The Secure Act And The Demise Of The Stretch Ira Seeking Alpha

2